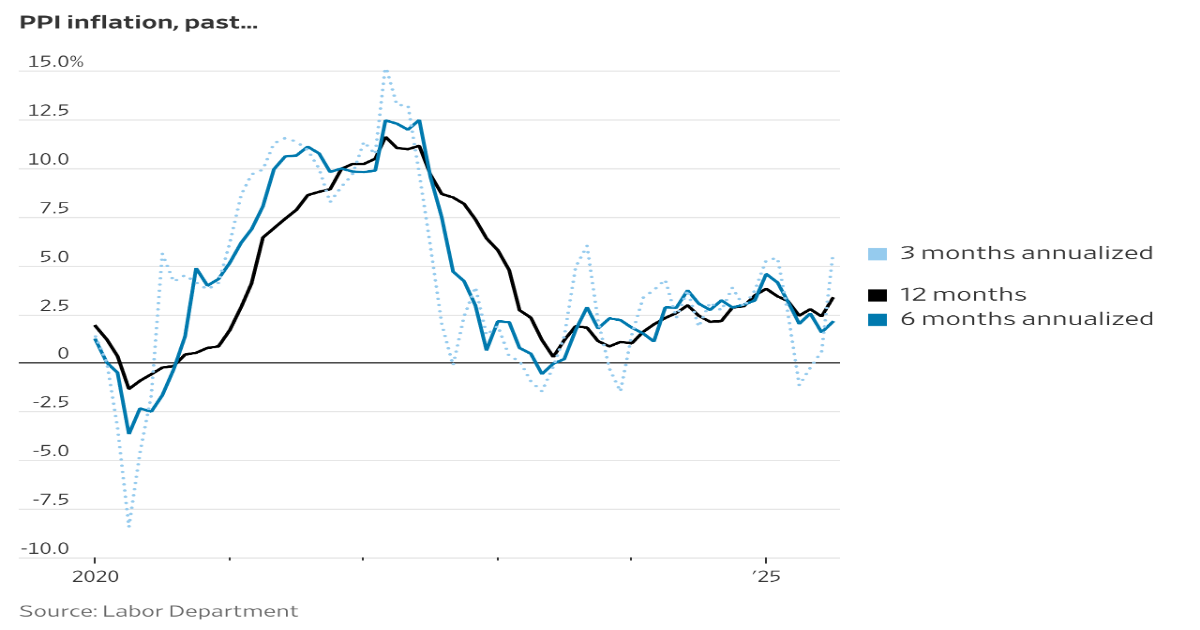

Wholesale prices rose at the sharpest monthly rate in three years, raising fresh alarm that tariffs are pushing up inflation. The data complicates the picture for the Federal Reserve by nudging the central bank’s preferred inflation gauge in the wrong direction.

Traders pared bets on a September interest-rate cut slightly. After Tuesday’s reassuring consumer-price index, futures markets had suggested investors were highly confident the Fed would cut rates in September. Treasury Secretary Scott Bessent had talked up a larger, 0.5 percentage-point cut. But San Francisco Fed President Mary Daly pushed back against the case for a jumbo cut, while Chicago Fed President Austan Goolsbee also signaled caution.

Stocks were mixed Thursday while Treasury yields rose. Bellwether 10-year Treasury yields, a key indicator of borrowing costs, rose 0.053 percentage point to 4.292%. Major equity indexes were little changed.